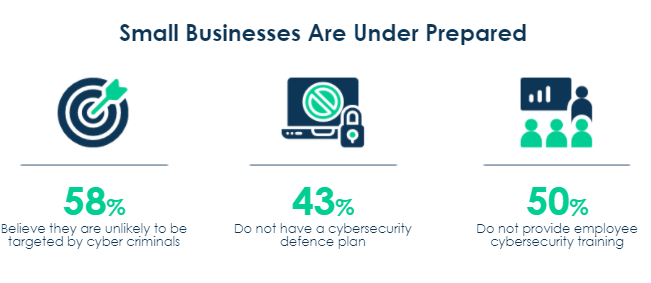

If you're a small to medium-sized business owner, you're at risk for a cyber attack. Almost half of cyber attacks target SMBs because they know smaller organizations may lack the in-house resources that enterprises have. This is why having cyber insurance is key. Cybercriminals recognize that smaller businesses can't afford downtime and are more likely to respond to extortionate demands. Cyber insurance is a key element in creating a unified front against cyber threats and protecting your business against prying cybercriminals.

Here's What You Need to Know About Cyber Insurance:

Cyber Insurance Benefits for SMBs

Having a layered cyber security approach is the best course of action. Cyber security plans are designed to protect you and your business. However, they are imperfect, as new threats emerge daily and human error persists. That's why it's so important to choose a cyber insurance provider that covers the following:

- Cyber Insurance Products and Coverage

- It is important to understand exactly what 1st and 3rd party losses are included in your coverage, such as breach, ransomware, cyber crime, cyber terrorism, and risk analysis tools.

- Pre-Breach Services

- Your company should have the most up-to-date and appropriate analysis of your individual cyber risk in financial terms. You want to select a company that can also analyze your individual IT systems and cybersecurity risk.

- Breach Response Services

- Know what to do after a breach, such as PCI re-certification services, notification expenses, foreign notification, PR expenses, overtime compensation, reputational harm, etc.

- Distribution

- You need an insurance company that can work directly with your MSP and IT team. By leveraging the expertise of your IT team, MSP, and your insurance company, you will have the best cyber coverage, paired with the best cyber risk tools, all within a few mouse clicks.

- Cyber Tools

- Work in partnership with managed security service providers that are certified to help prevent breaches and remediate if they occur.

- Work in partnership with managed security service providers that are certified to help prevent breaches and remediate if they occur.

When choosing a cyber insurance provider, you want a provider that can help cover costs associated with system restoration and lost revenue and reduce liability from exposed confidential data. It is also essential that your insurance provider and IT team can work together to streamline the process after a security event.

The High Cost of Forgoing Cyber Insurance

If you choose to forgo purchasing cyber insurance, there are some things you should know. According to an IBM study, the average cost of a data breach for businesses with fewer than 500 employees increased from $2.92 million to $3.31 million in 2023. You or your business are not getting any of that money back if you don't have cyber insurance. But it's also worth remembering that the wrong insurance policy also won't help you recoup losses after a security incident. Here are five warning signs an insurance provider isn't going to work for your business:

- Some do not provide or recommend the right coverage

- When considering cyber insurance, you need to make sure it covers the most common problems including breach, ransomware, cybercrime, and cyber terrorism - and can properly evaluate your risk (based on actual data, not black-box formulas).

- Not all carriers help you avoid a breach.

- Some don't do proper analysis to identify potential problems and do not provide security awareness training, a risk reduction plan, or adequate information - critical if a problem occurs.

- Most do not provide immediate help.

- Most insurance companies do not know your business and require you to hunt for an approved security expert if a breach occurs.

- They don't recommend or leverage existing cybersecurity tools

- You need tools that will effectively prevent and respond to cyber attacks, plus fast expert help, preferably from someone who knows your business, IT systems, and team.

- Most do not have any sources to help fix your breach

- Some will pay to replace but do little to help you recover (which is the more significant loss) - and most don't even know who can help you.

- Some will pay to replace but do little to help you recover (which is the more significant loss) - and most don't even know who can help you.

60% of small businesses who experience a cyberattack go out of business within six months. 43% of all cyber attacks in 2023 targeted small businesses. These attacks could have originated as data breaches, business interruptions, or cyber extortions, which are all common cyber attacks. According to DataStream, 89% of businesses who have cyber insurance said that it covered their losses and that they were very glad they did have it.

Finding the Right Cyber Insurance Policy

When it comes to cyber insurance, look for solutions that offer coverage at a competitive price, create simple and understandable models based on extensive data, and outline a plan of action before a breach occurs. Choosing a plan with these three aspects will give your business the best overall outcome. Remember, cyber insurance shouldn't be your only point of protection. Consider implementing these additional security tools and contacting iCorps for a free cyber security and insurance consultation.

![[BLOG] IT Support, Security & Managed IT Services](https://www.icorps.com/hubfs/2022%20Webp%20Image%20Files/Hero%20Images/New%20Upright%20Hublox%20webp.webp)